Short-Term Business Loans in 2023: Everything You Need to Know

Your dream business is all set and running; you’re expanding, scaling up, and finding growth opportunities, but you don’t know how Short-Term Business Loans work, and business is moving fast.

And then suddenly, things start going south. You encounter an unexpected problem and need quick money to fix things. This could be an issue with the working capital or an urgent need for equipment.

How do you navigate this challenge?

Where do you look for the capital?

Is it a loan? But which loan is suitable? How do you navigate the complexities of paperwork?

Sounds relatable? We understand you.

It’s common to feel directionless and overwhelmed with the multiple options available in situations like these. Don’t stress, though! A short-term business loan might be just the solution you require right now.

But, of course, making smart financial choices is key to your business’s success. In 2023, there’s a whole range of short-term business loan lenders out there, each with its own unique offerings. For instance, Lender A might charge 10 cents on the dollar, while Lender B is at 20 cents, and Lender C goes up to 30 cents.

As you can see, it’s essential to do your homework and compare these interest rates before making a decision.

In this blog, we will explore short-term business loans, how it operates, and their different features. A major bonus? BitX Capital helps you find the right lender for your business’s urgent monetary needs.

Sounds helpful? Let’s find out what a short-term business loan is and how it can help you.

What is a Short-Term Business Loan, and What Does it Do?

Simply put, a short-term business loan helps you support a temporary business capital need. It’s a credit type that requires you to pay the principal amount with interest within the given due date. In most cases, the repayment tenure might vary and is between six months to twenty-four months.

Scaling your business often comes with its own set of challenges, and securing a significant credit limit from a bank can be one of them. Banks typically view new businesses as higher risk, which may result in limited access to funds.

In situations where your business faces urgent financial demands, such as unexpected expenses or limited-time opportunities, a short-term loan can offer a vital lifeline. It helps to tackle these immediate needs and secure your business’s ongoing growth and success.

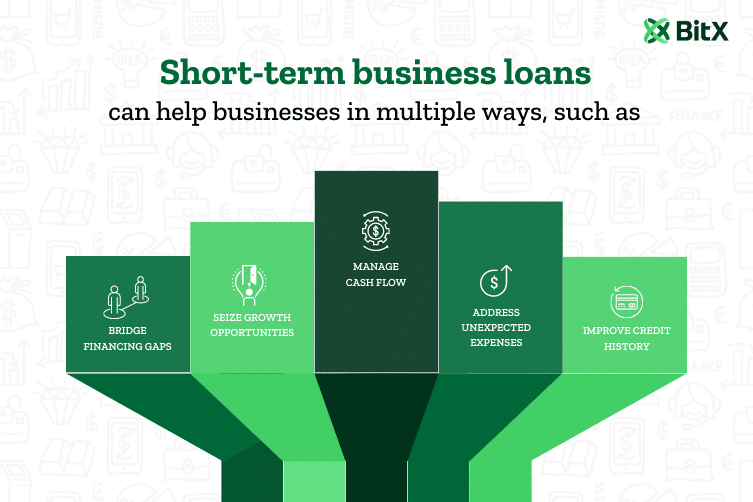

Short-term business loans can help businesses in multiple ways, such as:

- Manage cash flow: They can be used to cover temporary cash flow shortages, such as paying salaries, bills, or other operational expenses when revenue is delayed or seasonal fluctuations occur.

- Address unexpected expenses: Unforeseen expenses, such as equipment breakdowns or urgent repairs, can be covered by a short-term loan, ensuring that business operations continue smoothly.

- Seize growth opportunities: Short-term loans can provide businesses with the capital needed to take advantage of time-sensitive opportunities, such as expanding inventory, launching a marketing campaign, or investing in new technology.

- Bridge financing gaps: Businesses can use short-term loans to bridge the gap between long-term financings, such as awaiting approval for a larger loan or an investor’s funding.

- Improve credit history: By successfully repaying a short-term loan, businesses can build or improve their credit history, which may increase their chances of securing more favorable financing terms in the future.

Approval for a loan depends on your eligibility and credit history. It’s essential to identify a suitable lender who offers a high credit limit and the lowest interest rate to ensure the best financing option for your needs.

Let’s take you through the detailed process of securing a short-term business loan for your urgent needs.

How to Get a Short-Term Loan for Your Business?

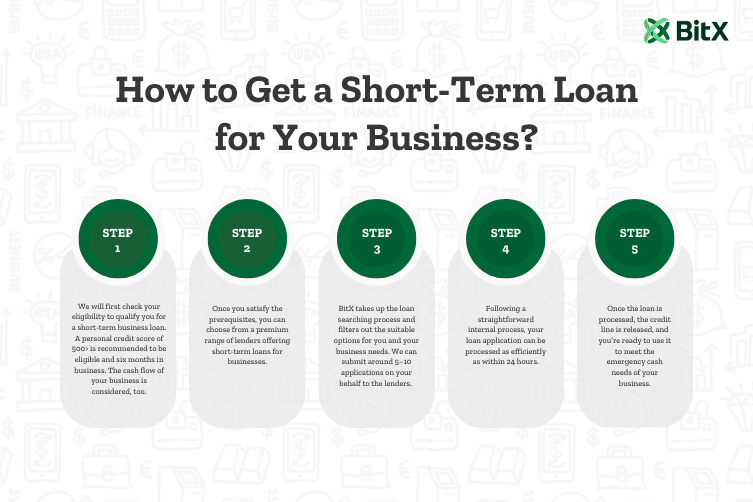

Securing a short-term loan through BitX Capital is simple and easy, here are some steps you need to follow:

Step 1:

We will first check your eligibility to qualify you for a short-term business loan. A personal credit score of 500> is recommended to be eligible and six months in business. The cash flow of your business is considered, too.

Step 2:

Once you satisfy the prerequisites, you can choose from a premium range of lenders offering short-term loans for businesses.

Step 3:

BitX takes up the loan searching process and filters out the suitable options for you and your business needs. We can submit around 5–10 applications on your behalf to the lenders.

Step 4:

Following a straightforward internal process, your loan application can be processed as efficiently as within 24 hours.

Step 5:

Once the loan is processed, the credit line is released, and you’re ready to use it to meet the emergency cash needs of your business.

BitX serves as a convenient platform for addressing your financial needs, making the lending process smoother. With a focus on short-term business loans that benefit businesses, BitX presents a variety of options tailored to accommodate your unique financial circumstances.

We can consider an example here. Your business space is healthcare, and you have just started. The bank has rejected you for a credit limit, and now you’re worried. Don’t worry, we have your back! BitX even supports industries that banks could retract, like restaurants, cannabis, clothing, healthcare, landscapes, transportation services, etc.

Let’s now explore the eligibility criteria to secure a short-term loan for your business.

Eligibility for Short-Term Business Loan

Check out the eligibility factors below to secure a short-term loan:

- Business Tenure: Your business must operate for at least six months.

- Deposits: The monthly deposit numbers need to be above $10k.

- Personal FICO: Personal FICO needs to be more than 500>.

- A Business Checking Account is also compulsory to be eligible for a short-term loan for your business.

You meet these prerequisites and boom! You’re good to get a short-term business loan to secure your business’s urgent monetary needs.

Loan Details

Check out the crucial details on your loan here:

- The maximum loan amount could be between $5k and $500k, based on your needs, eligibility, and lender options.

- Different lenders have separate repayment terms. In most cases, it’s between 3 months and 24 months.

- The interest rates are cents on the dollar and follow fast processing, usually within 24 hours after receiving your application.

Understanding the features of short-term business loans can be crucial in making informed financial decisions for your business. To gain clarity, let’s take a closer look at the various attributes of short-term business loans.

Features of Short-Term Business Loans

1: Higher Annual Percentage Rate

Because of its short tenure, the lender might not be making sufficient profits. That’s why it has a high annual percentage rate or interest rate. The usual repayment tenures for short-term loans are between 1 and 2 years, which results in less accrued interest.

Long-term loans are advantageous for lenders because the extended repayment period accumulates more interest, while short-term loans usually have higher interest rates. This compensates for the lender’s reduced profit potential due to the shorter repayment time frame.

2: Unsecured Loan

Short-term loans are unsecured, and resultantly, they do not require collateral. To mitigate this risk, lenders charge higher interest rates for short-term business loans, which helps compensate for any potential losses from defaults.

3: Good Credit Score

Since short-term loans don’t require collateral, lenders rely on a thorough examination of your credit history. A strong credit score and report can secure better loan offers for you.

Your credit score serves as a measure of your trustworthiness to the lender. A solid score alleviates their concerns about lending money for temporary business requirements. The higher your score, the more likely you are to be approved for favorable loan offers. Even if you have a poor personal credit history but demonstrate robust business revenue, you may still qualify for a small business loan.

4: Strict Repayment Schedules

Short-term business loans provide a solution for unexpected cash requirements in your business. Given their importance, lenders enforce a stringent repayment schedule for these loans.

Typically, the loan term ranges from one to two years, or even shorter, depending on the lender’s policies and your eligibility. Full repayment of both the principal and interest is required within the loan term. Some small business loans may also feature weekly repayment schedules.

Let’s move on to explore the different advantages of a short-term business loan.

Advantages of Short-Term Business Loans

If you’re unsure whether a short-term business loan is the right choice for your needs, sit back! You’ll be elated to see the advantages of a short-term loan for your business.

1: Shorter span for incurring interest

Due to their shorter terms, usually, within a year or two, small business loans often have higher interest rates to account for the increased risk to the lender. For instance, with a long-term loan, you pay interest over a more extended period. In contrast, short-term loans have comparatively higher interest rates, which results in a greater total interest amount paid relative to other types of loans.

2: Fast funding time

Short-term business loans come with a shorter maturity date, making it less likely for the borrower’s ability to repay to change significantly within that time frame.

Take Jack, a business owner, as an example. With a repayment tenure of six months, it’s unlikely that his ability to repay will fluctuate during this brief period. As a result, the lender can process the loan more quickly, providing Jack with fast access to funding. This allows him to concentrate on addressing his business’s financial needs without delay.

3: Easier to get

Short-term loans offer easier access to funding. Even if you have a poor personal credit history but strong cash flow in your business, you can still qualify for a small business loan. Businesses generating more than $10k per month in revenue are more likely to be approved.

With short-term business loans, the borrowed amount tends to be smaller compared to long-term or midterm loans, making them a quicker and more accessible option.

So, even if a business owner has poor personal credit but excellent cash flow, they can still obtain a short-term loan. However, the cost of capital may be higher due to the increased risk associated with the borrower’s credit history.

4: Fits your immediate cash needs

Running a business is a roller coaster ride, and there can be unexpected roadblocks. Wrong finance decisions could worsen them. That’s where short-term business loans are helpful.

Rather than risking your home through a mortgage, a short-term business loan offers a safer option to manage urgent cash needs.

However, obtaining a short-term business loan comes with its own set of challenges. You must meet specific eligibility criteria to qualify for such a loan.

Let’s examine the various challenges associated with securing a short-term business loan.

Disadvantages or Challenges in Short-Term Business Loans

Check out the challenges below.

1: High Capital Cost

A robust cash flow can improve your odds of short-term business loan approval, but a higher cost of capital may result from increased credit risk.

2: Financial Documents

Financial documents have a big part in the approval, mostly four months of business bank statements. You have to keep them handy. Any glitch here will give the bank a reason to disqualify you for the small business loan.

Lenders review your financial statements, comparing them to prior periods, and analyzing various aspects of your business to determine your eligibility for a loan. This allows them to evaluate your ability to repay the loan amount and assess the risk associated with the loan.

3: An Interesting Business Plan

To evaluate the viability of your business concept, lenders usually review factors like financial forecasts and market analysis.

The last thing you want is rejection due to an unimpressive business plan. Therefore, it’s essential to prepare a stellar business plan that showcases your business’s potential and highlights your ability to repay the loan. Meeting these criteria will increase your chances of approval and smooth out the process.

4: Low borrowing amount

Short-term business loans might have borrowing restrictions, which can be a disadvantage if you need significant financing.

With that, we wrap up the different features, advantages, and disadvantages of a short-term business loan.

Let’s move to compare short-term business loans with other loan options available out there.

Short-Term Business Loans vs. Mid-Term Business Loans: A Comparison

In addition to short-term loans, other financing options, such as midterm loans, are available to businesses. Midterm loans provide a longer repayment period than short-term loans, typically ranging from one to five years, with a repayment schedule of three to five years being the most common.

Business term loans fit when you require funding for projects or investments that demand a more extended repayment period. Business term loans often require collateral and a robust credit history, which can make obtaining them challenging for some businesses.

Here are some key features of business-term loans that you may want to consider:

- Medium-term loans can offer up to a financing of $500,000 and have monthly or bi-monthly repayment schedules. Short-term loans, on the other hand, let you borrow anywhere between $5 and $10,000.

- When it comes to medium-term loans, the usual funding duration falls within the range of two to three weeks. In contrast, short-term loans generally follow a 24-hour funding policy in most cases.

- Like short-term business loans, you’re medium-term with a clean cash flow, good credit rating, and credit history.

- These loans are a good pick for small business owners with comparatively more repayment time than short-term business loans.

Short-Term Business Loans vs. SBA 7A Loan: A Comparison

If you find yourself in a situation where your business is thriving, and you need to scale up to meet increasing demand, a short-term loan may not be the best fit. In such cases, an SBA 7A loan may be a more suitable option.

Compared to short-term loans, SBA 7A loans offer a much longer repayment schedule, typically ranging from 10 to 25 years, depending on the lender and the borrower’s eligibility. This makes them an excellent choice for businesses that require substantial funding to expand or invest in new equipment or facilities.

SBA 7A loans are backed by the Small Business Administration (SBA) and offer competitive interest rates, making them a cost-effective option for long-term financing needs. However, like other loan types, SBA 7A loans may require collateral and a robust credit history to qualify.

Here are some features you want to check on the SBA 7A loans.

- These are lent mainly by banks and backed by the U.S. Small Business Administration.

- Due to longer repayment schedules and low-interest rates in sharp contrast to short-term loans, it isn’t easy to qualify for the SBA 7A.

- Like short-term business loans, you can use an SBA 7A loan for working capital, expanding your start-up, and buying equipment and supplies.

Short-Term Business Loans vs. Business Line of Credit: A Comparison

A business line of credit allows you to borrow a certain amount of money for your business needs, and you only have to repay the amount you have spent. Unlike a short-term loan, which provides a lump sum of cash upfront, a business line of credit gives you access to a revolving line of credit that you can use to manage ongoing expenses.

Business lines of credit typically have lower interest rates than short-term loans, making them a cost-effective option for businesses that need ongoing access to funds. However, they may require collateral and a robust credit history to qualify.

Here are a few things you’d like to know about the business line of credit.

- A line of credit is beneficial to meet your unexpected business needs for long-term growth.

- Unlike short-term business loans, a line of credit lets you use a specific sum that you can use as per the need,

- Line of credit is also significant to help you develop your business credit.

- Like a business credit card, unlike short-term business loans, you are entitled to a higher credit limit based on your eligibility.

You have now gained a better understanding of the various loan types available to businesses. Short-term loans are ideal for addressing sudden financial needs, while medium-term loans offer longer repayment schedules.

SBA 7A loans offer low-interest rates over an extended period, but they’re challenging to qualify for. Business lines of credit provide a revolving credit line. It can be used for ongoing expenses and long-term growth, and repayment is required only for the amount borrowed.

Each loan type has unique features, advantages, and disadvantages. Carefully assess your business needs when choosing a loan. Determine which loan type aligns best with your goals to secure the funding you require for business growth and success.

The Bottom Line

This comprehensive overview of short-term business loans and their features has offered you valuable insights into financing options. Sound financial decision-making is vital in accomplishing your business objectives, and we’re here to assist you.

BitX Capital is an expert in short-term loans and has over a decade of experience in the industry. Over the years, we have placed numerous loans and have become a trusted authority in the field. Our commitment to adhering to bank best practices has made us a preferred choice for many businesses.

Why BitX Capital for Small Business Loans:

We recognize that every business has distinct financing needs, and BitX Capital offers customized solutions to meet them. Our experienced team assists you in making informed decisions and selecting the best financing options for your enterprise.

Our track record of providing excellent service to our clients has earned us numerous raving fans, which can be seen on Trustpilot and BBB. We take pride in simplifying finance for our clients and providing them with seamless experiences.

Whether you’re just starting or looking to scale your business, our exclusive offers and financing options can help you achieve your goals. With years of experience and specialized training, we’re a trusted name in business loans, even for businesses lacking initial capital.

We have made financial decisions easy for hundreds of customers; now it’s your turn! Book a call today at 203-763-1430.

FAQs

How can short-term financing be used to start a business?

Starting a business can require borrowing money for various purposes such as working capital, equipment purchase, or maintaining cash flow. Short-term business loans can be used to address these emergency monetary needs.

What is the typical repayment period for a short-term business loan?

Short-term business loans usually have a repayment period ranging from 6 months to a year. However, the repayment period may vary based on the lender and the borrower’s credit history.

Are short-term loans beneficial for businesses?

Short-term loans can be a good option for businesses as they provide emergency cash and a fixed repayment period. However, it’s important to choose the right option that fits the business’s specific needs.

Why do businesses need short-term loans?

Small businesses may require short-term loans to fulfill immediate working capital needs, such as purchasing equipment or meeting bulk orders. Short-term loans can also be useful for business expansion and growth.